As it turns out, the advertisements on Facebook and Twitter really do suck (to use a technical term)!

That’s not just my opinion anymore; it’s the collective view of the respondents to One Blind Squirrel’s recent survey on the topic.

To be very clear, there is absolutely no statistical significance to these data, which are based on fewer than 100 responses from people more like me than not (i.e., primarily friends and family, I believe); moreover, I’m not a statistician (far from it). That said, there is, in fact, an obvious thematic significance to these responses that I think is worth dissecting.

According to the collected data, users almost uniformly find advertisements on Facebook and Twitter both very annoying and effectively irrelevant, while rarely, if ever, transacting as a result of exposure to them. Charts 1-3 (below) show the averages from all applicable respondents.

Annoying. Irrelevant. No impact. Ouch!

Overall, these views are so damning in my mind that I almost wonder if advertisers on these platforms wouldn’t be better off just giving their “social” marketing budgets away at random, rather than paying for the privilege of potentially damaging their own brands and/or their relationships with their customers, with little, if any, new revenue as an offset.

And, yet, Facebook and Twitter dominate marketers’ “social” spending, generating an estimated $6-7 billion in advertising revenue this year.

This contrast is striking to me.

In a not-so-strange way, these dynamics remind me of Yahoo! circa 1996-2000. At that time, the company’s dominance of the Web and status as a potential “kingmaker” allowed it to command huge sums of money from companies looking to “lock-up” its prime real estate. Yahoo! certainly wasn’t the only game in town, but it was one of the biggest and had the aura of being the best. As a result, the line of companies anxious to deliver sacks full of money to Yahoo! stretched from Sand Hill Road to Madison Avenue and beyond.

Unfortunately for those companies — and, ultimately, for Yahoo! — the deals didn’t work financially, with returns plummeting on marketing dollars invested. Ad rates were (way) too high. Paying customers delivered were (way) too low. And, both revenue and profit generated were (way) too weak.

Over time, this recurring shortfall, coupled with a variety of meaningful exogenous factors, resulted in the .com “crash” of the early-aughts, with an enormous wave of .com meltdowns and downsizings and re-caps and re-orgs and shutdowns.

Hopefully, Facebook and Twitter avoid repeating history, by quickly improving the performance of, and receptivity to, the advertisements on their platforms, and/or by being certain to price these advertisements in line with the value delivered (perhaps Twitter’s timely acquisition of MoPub will prove a meaningful step in this direction?).

After all, imagine how much revenue these two “social” companies alone could generate if the advertisements on their platforms were just mediocre / tolerable and didn’t actually suck?!?!?!

ADDENDUM

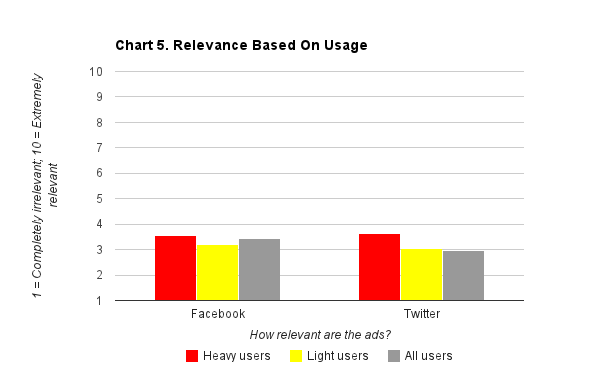

As a byproduct of this survey, I noticed a fascinating trend in usage variances between users of Facebook and Twitter.

In short, a high number of respondents seem to use Facebook all the time, whereas a fairly low number seem to use Twitter all the time. Perhaps more eye-opening, though, is the fact that a relatively high number of respondents seem to never use Twitter, while only a handful say the same of Facebook (see chart 7).

In short, a high number of respondents seem to use Facebook all the time, whereas a fairly low number seem to use Twitter all the time. Perhaps more eye-opening, though, is the fact that a relatively high number of respondents seem to never use Twitter, while only a handful say the same of Facebook (see chart 7).

Personally, I’m not shocked by this divergence, given my own issues with Twitter, speculation that user growth at Twitter has fallen short of plan, as well as Facebook’s reported numbers that highlight high levels of daily usage; nonetheless, it is still an enormous “yellow / orange-ish” flag that needs to be addressed quickly by Twitter’s leadership.